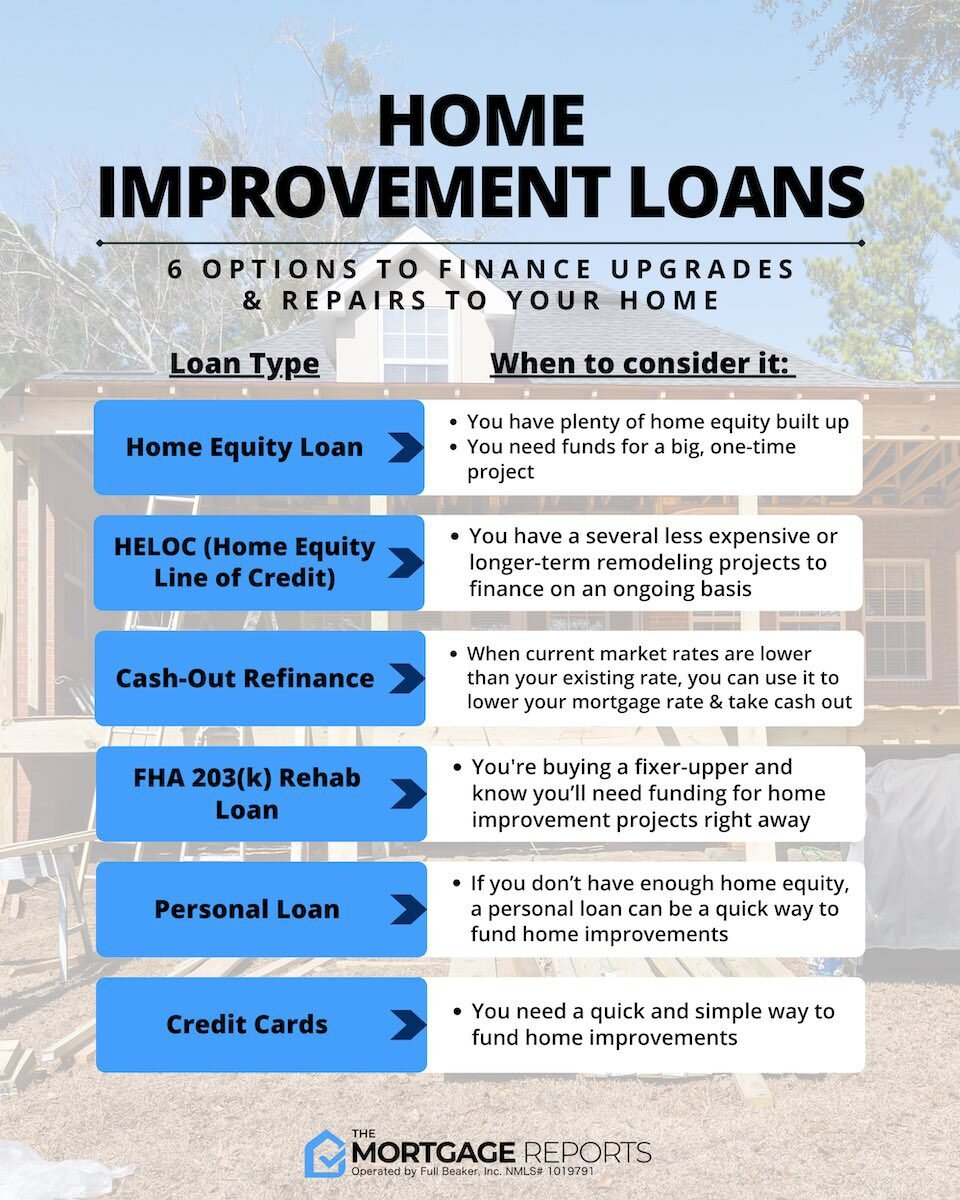

Welcome to our guide on exploring your options for home improvement financing! Whether you’re looking to renovate your kitchen, add a new bathroom, or upgrade your backyard patio, finding the right financing solution is crucial. With so many options available, it can be overwhelming to choose the best route for your specific needs and budget. In this article, we’ll break down the various financing options available to you, from personal loans to home equity lines of credit, to help you make an informed decision on how to fund your home improvement project.

Personal Loans for Home Improvement

When it comes to financing home improvement projects, personal loans are a popular choice for homeowners looking to increase the value of their property. Personal loans are unsecured loans that do not require any collateral, making them a flexible option for those who may not want to put their home at risk.

One of the main advantages of using a personal loan for home improvements is that they typically have lower interest rates compared to credit cards. This can save you money in the long run, especially if you are planning on making significant renovations to your home. Additionally, personal loans offer fixed interest rates, which means your monthly payments will remain the same throughout the life of the loan.

Applying for a personal loan is also relatively easy and can be done online or in-person at a bank or credit union. Lenders will evaluate your credit score, income, and debt-to-income ratio to determine if you qualify for a loan and what interest rate you will be offered. It’s important to shop around and compare rates from multiple lenders to ensure you are getting the best deal.

Personal loans for home improvement projects typically have a repayment term between one to five years, but some lenders may offer longer terms depending on the amount borrowed. Keep in mind that the longer the term, the more interest you will pay over the life of the loan. It’s important to carefully consider how much you can afford to borrow and what monthly payments you can comfortably make.

Before taking out a personal loan for home improvements, it’s crucial to create a detailed budget outlining the cost of the project and what funds you will need. This will help you determine how much money you need to borrow and how it will be allocated towards the renovations. Additionally, having a solid plan in place will make it easier to stay on track with your spending and ensure the project is completed within budget.

In conclusion, personal loans are a practical and convenient option for homeowners looking to finance home improvements. With competitive interest rates, flexible terms, and easy application process, personal loans provide a straightforward way to fund your renovation projects. Just be sure to carefully evaluate your financial situation and create a budget to determine how much you can afford to borrow for your home improvements.

Home Equity Line of Credit (HELOC)

Another popular option for financing home improvements is a Home Equity Line of Credit, also known as a HELOC. A HELOC is a type of loan that allows homeowners to borrow against the equity in their homes. Equity is the difference between the current market value of the home and the amount that is still owed on the mortgage. HELOCs are typically revolving lines of credit, meaning that homeowners can borrow up to a certain amount over a specified period of time, known as the draw period.

One of the key advantages of a HELOC is flexibility. Unlike a traditional home equity loan, where homeowners receive a lump sum upfront, HELOCs allow borrowers to draw funds as needed, up to a predetermined limit. This can be beneficial for homeowners who are unsure of the total cost of their home improvement project or who may have ongoing expenses.

Additionally, HELOCs often have lower interest rates compared to other financing options, such as personal loans or credit cards. The interest rates on a HELOC are typically variable, meaning that they can fluctuate over time based on market conditions. However, many lenders offer the option to convert a portion of the HELOC to a fixed rate, providing homeowners with the security of a consistent monthly payment.

Another advantage of a HELOC is that the interest paid on the loan may be tax-deductible, as long as the funds are used for home improvements. This can provide homeowners with additional savings on their taxes each year.

It’s important to note that using a HELOC to finance home improvements does come with risks. Because the loan is secured by the equity in the home, failure to make payments on time could result in the loss of the property through foreclosure. Additionally, if property values decrease, homeowners may find themselves owing more on the HELOC than the home is worth.

Before taking out a HELOC, homeowners should carefully consider their financial situation and ensure that they are able to make timely payments. It’s also a good idea to shop around and compare offers from different lenders to ensure that they are getting the best terms and rates for their needs.

Financing through Home Improvement Stores

When it comes to financing your home improvement projects, many people turn to home improvement stores for assistance. These stores often offer financing options that can help you make your dream home a reality without breaking the bank. Here are a few ways you can finance your home improvement projects through home improvement stores:

1. Store credit cards: Many home improvement stores offer store credit cards that come with special financing options. These cards often provide benefits such as discounts on purchases or special financing offers like zero percent interest for a certain period of time. While these cards can be convenient, it’s important to read the fine print and understand the terms and conditions before signing up for one.

2. In-store financing programs: Some home improvement stores offer in-store financing programs that allow you to make purchases and pay them off over time. These programs may come with low interest rates or deferred interest options, making them a popular choice for homeowners looking to finance their projects. Just like with store credit cards, it’s crucial to fully understand the terms of the financing program before committing to it.

3. Contractor partnerships: Another option for financing through home improvement stores is through contractor partnerships. Some stores have relationships with local contractors who offer financing options to customers purchasing materials through the store. This can be a convenient way to finance your project as it may streamline the process of both purchasing materials and hiring a contractor. Additionally, some stores may offer special discounts or promotions for customers who choose to finance their projects through their partner contractors.

Choosing to finance your home improvement projects through a home improvement store can provide you with convenience and flexibility. Whether you opt for a store credit card, an in-store financing program, or a contractor partnership, be sure to do your research and compare your options to find the best financing solution for your needs. Remember to budget responsibly and make sure you can afford the monthly payments before committing to any financing agreement.

Government Programs for Home Renovation

When it comes to financing home improvement projects, there are several government programs available to assist homeowners in making their homes more comfortable, energy-efficient, and safe. These programs are designed to provide financial assistance to individuals who may not qualify for traditional loans, or who need extra help in funding their renovation projects.

One popular government program for home renovation is the Federal Housing Administration’s 203(k) program. This program allows homeowners to finance both the purchase and renovation of a home with a single mortgage loan. This can be especially helpful for individuals who are looking to purchase a fixer-upper and make necessary repairs and upgrades. The 203(k) program offers competitive interest rates and flexible terms, making it a great option for those in need of financing for home renovations.

Another government program that can help homeowners with their renovation needs is the U.S. Department of Agriculture’s Rural Development program. This program offers loans and grants to low-income individuals in rural areas to make repairs and improvements to their homes. The funds can be used for a variety of projects, including upgrading plumbing and electrical systems, installing energy-efficient appliances, and making structural repairs. The Rural Development program is a valuable resource for homeowners who may not have access to traditional financing options.

In addition to federal programs, there are also state and local government programs that offer assistance to homeowners in need of renovation financing. For example, many states offer grants and low-interest loans to help homeowners make energy-efficient upgrades to their homes. These programs can help offset the cost of installing solar panels, upgrading insulation, and replacing old windows and doors. By taking advantage of these resources, homeowners can not only improve the comfort and value of their homes but also save money on energy bills in the long run.

Overall, government programs for home renovation can be a valuable resource for homeowners in need of financial assistance. Whether you are looking to purchase a fixer-upper, make energy-efficient upgrades, or complete necessary repairs, there are programs available to help you achieve your home improvement goals. By exploring these options and taking advantage of the resources available, you can make your home more comfortable, safe, and energy-efficient without breaking the bank.

Using Credit Cards for Home Improvement

One popular method of financing home improvement projects is using credit cards. Credit cards can be a convenient way to pay for home improvements as they offer flexibility and can be used for a wide range of expenses. However, it is important to use credit cards responsibly to avoid getting into debt and paying high interest rates. Here are some tips for using credit cards for home improvement:

1. Compare interest rates: Before using a credit card to finance your home improvement project, it is important to compare interest rates on different cards. Look for cards with low interest rates or introductory offers that can help you save money on interest payments.

2. Use a rewards card: If you have a rewards credit card, consider using it for your home improvement expenses. You can earn cash back, points, or miles on your purchases, which can help offset the cost of your project.

3. Create a repayment plan: Before charging your home improvement expenses to a credit card, create a repayment plan to ensure that you can afford to pay off your balance in a timely manner. Make sure to budget for monthly payments to avoid accruing high interest charges.

4. Avoid maxing out your credit card: It is important to keep your credit utilization ratio low to maintain a good credit score. Try not to max out your credit card by using it for large home improvement expenses. Instead, consider spreading out the costs over multiple cards or other financing options.

5. Be aware of hidden fees and charges: When using a credit card for home improvement, be sure to read the terms and conditions carefully to understand any fees or charges that may apply. Some credit cards may have annual fees, balance transfer fees, or foreign transaction fees that can add to the overall cost of your project.

By following these tips, you can use credit cards responsibly to finance your home improvement projects. Just remember to budget carefully, compare interest rates, and avoid accruing debt that you cannot afford to repay. With responsible use, credit cards can be a convenient and flexible financing option for your home improvement needs.

Originally posted 2025-04-05 13:57:18.